- Hedera combines enterprise partnerships, scalability, and energy efficiency for sustained blockchain adoption and growth.

- Binance Coin powers the Binance ecosystem with strong utility, resilience, and consistent performance across market cycles.

- Algorand delivers fast, low-cost, and sustainable blockchain solutions driving large-scale financial and real-world innovation.

The next bull market is shaping up, and smart investors are already scanning for high-potential altcoins. While Bitcoin often leads rallies, true profits usually come from strong projects with solid fundamentals. Several promising tokens have continued to build quietly behind the scenes, setting the stage for significant gains once momentum returns. Among them, Hedera, Binance Coin, and Algorand stand out as serious contenders ready to outperform across different market cycles.

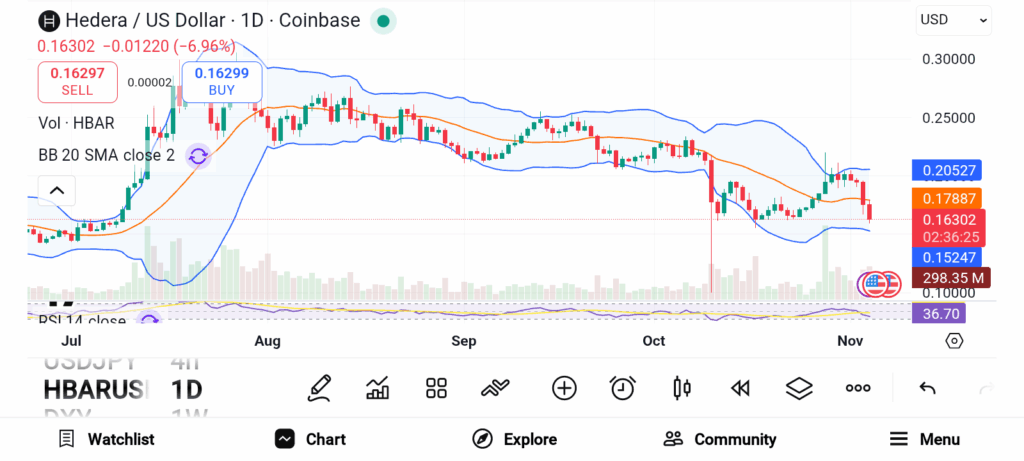

Hedera (HBAR)

Source: Trading View

Source: Trading View

Hedera continues to stand apart from most blockchain projects thanks to its advanced hashgraph technology. This innovative system allows faster transactions and remarkable scalability while maintaining energy efficiency. The design gives Hedera an edge over traditional blockchains that often struggle with congestion and high fees. Large organizations have already recognized this potential. Partnerships with global enterprises continue to strengthen Hedera’s presence in real-world applications.

The network’s governance model, supported by leading companies, ensures transparency and long-term reliability. HBAR’s appeal lies in how it blends speed, cost-efficiency, and institutional trust. As enterprises seek secure and sustainable blockchain solutions, Hedera offers exactly that. Analysts expect the network’s strong fundamentals to support sustained growth as corporate adoption accelerates through 2025.

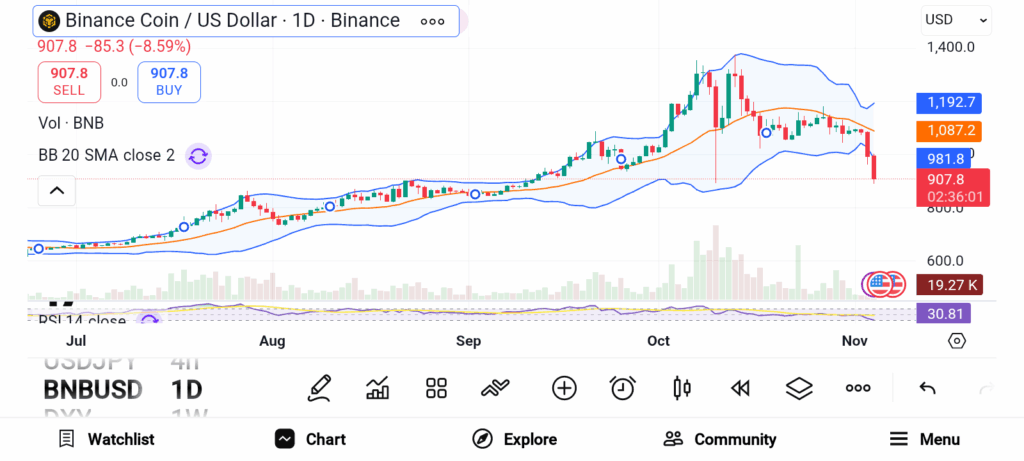

Binance Coin (BNB)

Source: Trading View

Source: Trading View

Few assets in crypto demonstrate the consistency of Binance Coin. Serving as the utility token for the Binance Smart Chain, BNB supports millions of daily transactions with impressive reliability. This performance reflects the deep integration of BNB within one of the industry’s most influential ecosystems. The token’s value extends beyond simple transactions. Developers use BNB for DeFi applications, staking, and network fees, driving continuous demand.

Binance’s ongoing innovation and regulatory adaptability further solidify BNB’s position as a market leader. During market corrections, BNB often shows strong resilience, bouncing back faster than many competitors. Institutional investors view this stability as a key reason to hold the token through market swings. With continuous upgrades and ecosystem expansion, BNB remains a pillar of strength in a volatile market.

Algorand (ALGO)

Source: Trading View

Source: Trading View

Algorand has steadily evolved into one of the most efficient and forward-looking blockchains. Designed for low-cost and high-speed transactions, the network focuses on large-scale financial applications. Developers continue to explore asset tokenization and payment systems built on Algorand’s fast and transparent framework.

The project’s consensus model promotes fairness, environmental sustainability, and strong performance. As more industries adopt blockchain for real-world integration, Algorand stands ready to support global scalability. With consistent upgrades and a growing ecosystem, ALGO’s potential for renewed attention in 2025 looks promising.

Hedera delivers enterprise-grade scalability and real-world partnerships driving long-term strength. Binance Coin anchors the most active crypto ecosystem with unmatched stability. Algorand continues to evolve as a fast, sustainable platform for financial innovation.