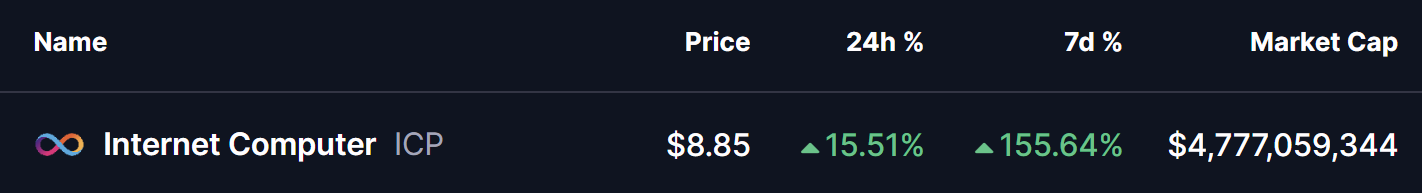

Date: Sat, Nov 08, 2025 | 06:50 PM GMT

The cryptocurrency market continues to highlight strong performance among Dino altcoins, and Internet Computer (ICP) is leading that narrative with an explosive rally of more than 150 percent in just one week. Now, attention is turning toward a powerful fractal setup forming on the weekly timeframe — one that has previously triggered a massive breakout rally.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Suggests Bullish Move Ahead

The weekly chart of ICP is showing early signs of a repeated bullish structure built around three key elements: a long accumulation zone, a falling wedge pattern, and a decisive reclaim of the 50-week moving average.

Back in late 2023, ICP corrected inside a falling wedge, where price found strong support near the $2.90 accumulation area. After months of compression, the token broke out of the wedge and reclaimed the 50-week MA, which triggered a massive 432 percent rally straight toward the ascending resistance trendline.

Internet Computer (ICP) Weekly Chart/Coinsprobe (Source: Tradingview)

Internet Computer (ICP) Weekly Chart/Coinsprobe (Source: Tradingview)

The current structure mirrors that earlier pattern closely.

ICP has once again bounced strongly from its multi-month accumulation zone, reclaimed the 50-week MA at $6.41, and broken out of its falling wedge’s resistance trendline near $8.58. The token is now trading around $8.90, supported by rising momentum and a sharp lift in RSI.

This fractal alignment suggests that ICP may be entering the early stages of another major expansion phase.

What’s Next for ICP?

For the fractal setup to remain valid, ICP must continue holding above the breakout zone and the 50-week MA at $6.41. Sustained strength above these levels would keep the bullish structure intact.

If the fractal plays out fully, the breakout suggests a potential move toward the next major target near $26.65, which sits roughly 195 percent above current prices. Beyond that, the broader trendline projection extends toward the long-term ascending resistance, opening room for even higher valuations later in the cycle.

However, a breakdown below the 50-week MA would weaken this fractal and put the bullish scenario at risk.

For now, ICP remains one of the strongest-performing Dino altcoins, and with this repeating technical structure in play, the token may have more upside ahead if buyers continue to defend key levels.