Bitcoin’s Price Fluctuations and Systemic Risks: Managing Institutional Withdrawals and Changes in the Macroeconomic Landscape

- Bitcoin's Q3 2025 ETF outflows reached $1.15B, driven by Fidelity and Ark, reflecting institutional risk recalibration amid structural vulnerabilities. - Macroeconomic factors like Fed rate cuts and U.S.-China tensions amplified Bitcoin's volatility, triggering an 18% price correction in October 2025. - ETFs now hold 6.7% of all Bitcoin , creating liquidity concentration risks as redemptions and inflows directly reshape exchange order-book dynamics. - Regulatory shifts, including India's SEBI trading cur

The volatility is

Underlying risks remain significant. Institutional withdrawals have reduced liquidity, with ETFs now accounting for 6.7% of all Bitcoin in circulation, according to a

Regulatory developments add further complexity. Organizations like Miqesia Investment Alliance are adjusting their strategies to meet international standards, focusing on transparency and compliance, as highlighted by a

Despite the instability, some remain optimistic. Michael Saylor of MicroStrategy believes that institutional involvement—through custody, lending, and risk management—is helping Bitcoin mature into a more stable asset. He predicts the price could reach $150,000 by the end of 2025, citing ongoing institutional accumulation and a developing ecosystem, as mentioned in a

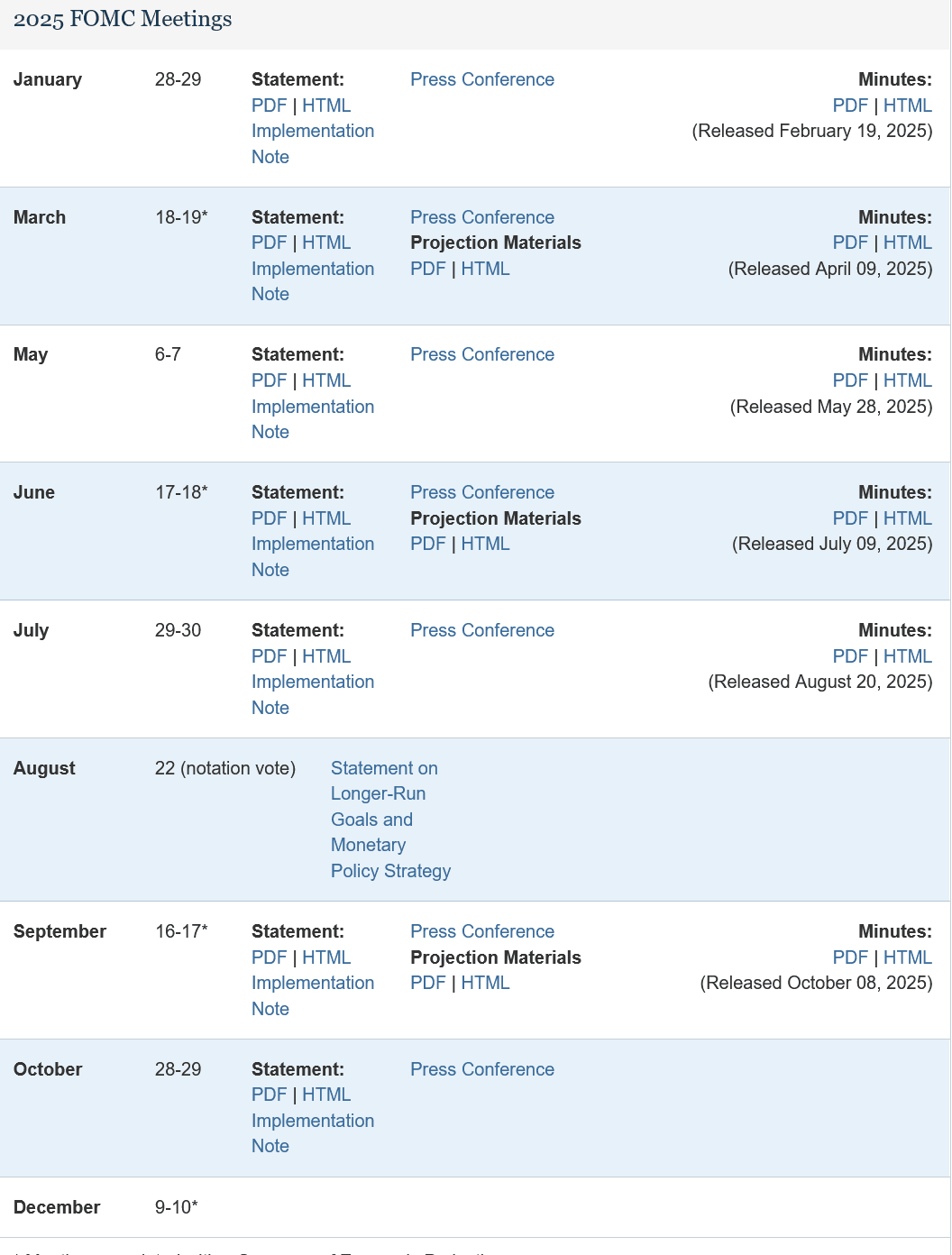

The future trajectory will depend on how well macroeconomic trends are balanced with structural stability. Although the Federal Reserve’s dovish stance and a growing M2 money supply ($96 trillion) provide some support, as CoinGecko notes, Bitcoin’s dependence on ETF liquidity remains a double-edged sword. For now, institutional investors seem to be playing it safe—pulling out during periods of volatility but returning when the market stabilizes, as seen on November 6, according to CryptoSlate.

Ultimately, Bitcoin’s price swings reflect the interconnected risks of the global financial system. Whether it becomes a reliable store of value or continues as a speculative asset will depend on the interplay between institutions, regulators, and macroeconomic forces in the coming months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Momentum (MMT) Experiences Rapid Growth as Strategic Acquisitions and Retail Investor Excitement Drive Demand

- Momentum (MMT) surged 44% in one hour on Nov 4, peaking at $0.6149 before a 42% drop in 24 hours amid $109M futures liquidations. - Binance's Nov 4 listing and 7.5M token airdrop boosted liquidity but triggered 16.17% post-listing price declines as retail speculation intensified. - MMT's DeFi role on Sui network lacks proven fundamentals, contrasting with unrelated entities like MFS Multimarket Income Trust and M&T Bank . - Retail-driven momentum and leveraged trading create high-risk/high-reward dynamic

Modern Monetary Theory and 2025 Cryptocurrency Price Forecasts: Managing Fiscal Growth and Broader Economic Uncertainties

- MMT-driven fiscal expansion in 2025 intersects with crypto markets, sparking debates on inflation hedges and policy risks. - Bitcoin's deflationary design challenges MMT principles, while stablecoins face downward pressure during monetary expansion. - Regulatory crackdowns and AI-powered cyberattacks amplify crypto risks amid MMT-era fiscal experiments. - BIS advocates balancing MMT with decentralized innovation to build resilient financial systems amid macroeconomic uncertainties.

What upcoming events may impact XRP Price?

Altcoins Oversold: Is This the Perfect Time to Buy?