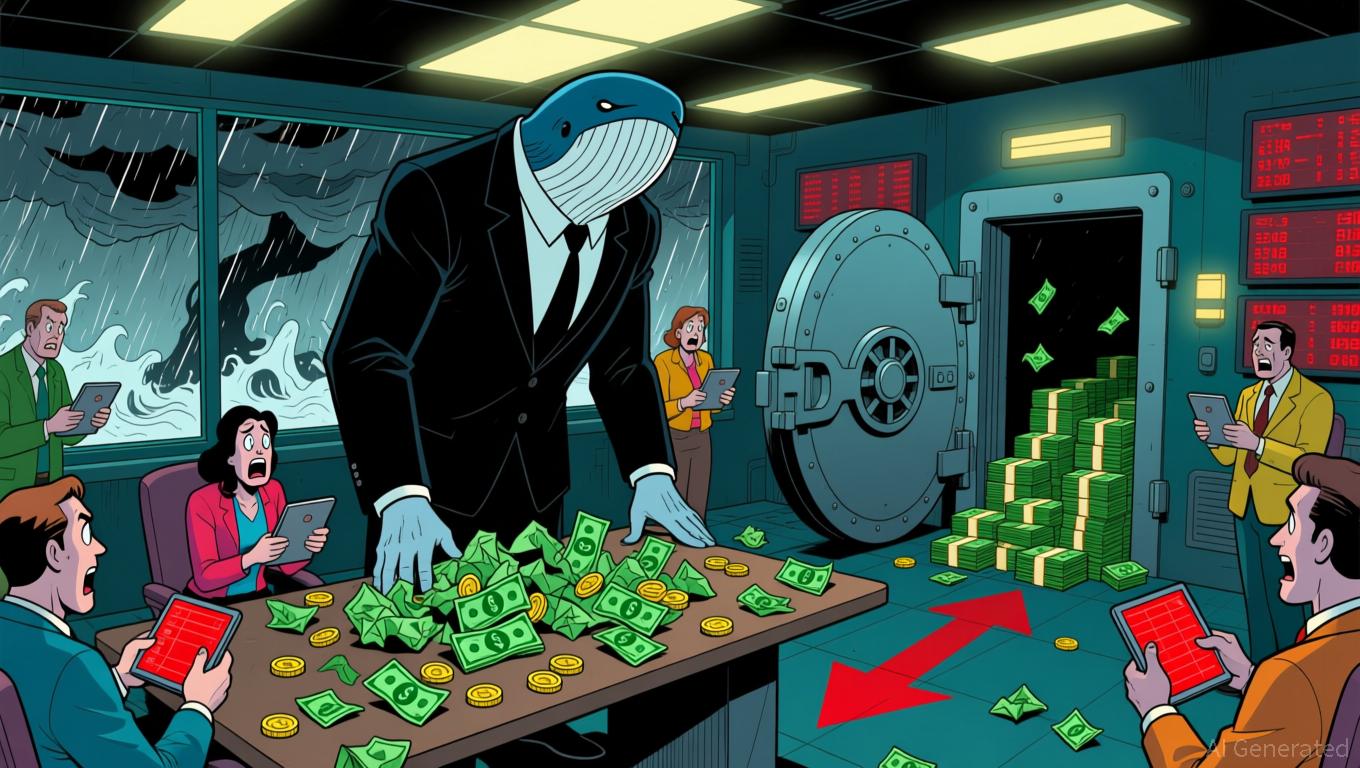

Bitcoin Update: Large Holders Depart and Economic Instability Push Bitcoin Under $100K

- Bitcoin fell below $100,000 as OG whales BitcoinOG and Owen Gunden moved $1.8B BTC to exchanges, signaling bearish bets. - $260M in long positions liquidated amid SOPR spikes, while Trump's crypto policies and China's $20.7B BTC holdings added macro risks. - Bit Digital staked 86% of ETH holdings for 2.93% yield, while Coinbase's negative premium highlighted waning U.S. buyer demand. - Analysts warn consolidation phases often follow whale profit-taking, with geopolitical tensions and derivatives volatili

On November 3, 2025, Bitcoin’s value plunged beneath $100,000 as significant selling from long-standing “OG” whales unsettled the market. According to blockchain analytics provider Lookonchain, two major players—BitcoinOG, a seasoned short-seller adept at capitalizing on market downturns, and Owen Gunden, who has been accumulating Bitcoin since the Satoshi era—shifted substantial

This wave of selling happened alongside broader market instability. Data from CoinGlass indicated that $260 million in long positions were wiped out within four hours, and the Spent Output Profit Ratio (SOPR) for short-term holders surged—a trend historically associated with periods of price stabilization, according to

The sell-off gained momentum amid rising macroeconomic concerns. U.S. President Donald Trump’s executive order to halt crypto enforcement and create a Strategic

Institutional moves continued to influence the market. Bit Digital Inc. announced that it had staked 86.3% of its 153,546 ETH holdings, earning a 2.93% annualized yield, as reported by

The market’s vulnerability was further highlighted by China’s increasing presence. Despite a domestic ban on crypto, Chinese investors reportedly hold 194,000 BTC ($20.7 billion), according to Bitget. Trump’s remarks about China’s advancements in blockchain and AI fueled additional concerns about the U.S. losing its economic edge, as noted in the same report.

With Bitcoin at a pivotal point, analysts point out that previous waves of profit-taking have often led to two to four months of price consolidation, a pattern CoinDesk has observed repeatedly. As whale activity and geopolitical issues intersect, the market’s future remains highly uncertain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Kite (KITE) Price Forecast and Market Outlook After Listing: Assessing Value, Institutional Engagement, and Near-Term Volatility Concerns

- Kite Realty (KRG) reported $4.82M Q3 2025 revenue shortfall despite 2.1% NOI growth and 12.2% leasing spreads. - Institutional ownership at 90.81% with $1.2B liquidity supports strategic grocery-anchored retail focus showing 56% leasing spreads. - Analysts cut price targets to $23-$26 while industry faces "F" rating due to macroeconomic risks and lack of sustainable earnings.

MMT Token TGE: A Major Debut with Notable Market Influence and Distinctive Tokenomics

- Binance's Momentum (MMT) TGE on Nov 4, 2025, saw an 885% price surge to $0.8859 within hours. - The TGE followed a 376x oversubscribed Binance Prime sale and included a 0.75% airdrop to BNB holders. - MMT's hybrid tokenomics combine inflationary potential with deflationary buybacks (20% marketplace fees, 15% quarterly profits). - Cross-chain strategy (BSC/Sui) and real-world asset integration aim to attract institutional/retail investors despite inflation risks.

Hyperliquid News Today: Hyperliquid's BLP and HIP-3 Indicate a Fundamental Change in DeFi Structure

Aster DEX Experiences Rapid Growth: Advancements in On-Chain DeFi and Improved User Access Attract Institutional Attention

- Aster DEX's 2025 upgrades transformed ASTER token into functional collateral for perpetual trading, enabling $800 leveraged positions per $1,000 ASTER. - Institutional validation followed CZ's $2M ASTER purchase and Coinbase's roadmap inclusion, coinciding with 30% price surge and $2B 24-hour trading volume. - 5% fee discounts and cross-chain expansion (BNB Chain, Ethereum , Solana , Arbitrum) enhanced accessibility, creating a flywheel effect through token retention and liquidity diversification. - $5.4