TRX News Today: TRX Gold's Cutting-Edge Technology Boosts Output and Prolongs Mine Operations

- TRX Gold accelerates Buckreef Gold Project expansion in Tanzania, targeting 3,000+ TPD throughput and 62,000-ounce annual gold production by 2027. - The $30M dual-circuit upgrade employs advanced tech to concentrate 87-90% of gold into 15% of processed mass, enhancing recovery rates and cost stability. - Analysts raised price targets (up to $1.20) citing execution capability, ESG focus, and phased internal financing reducing external risks. - Risks include equipment delays and recovery targets, but prior

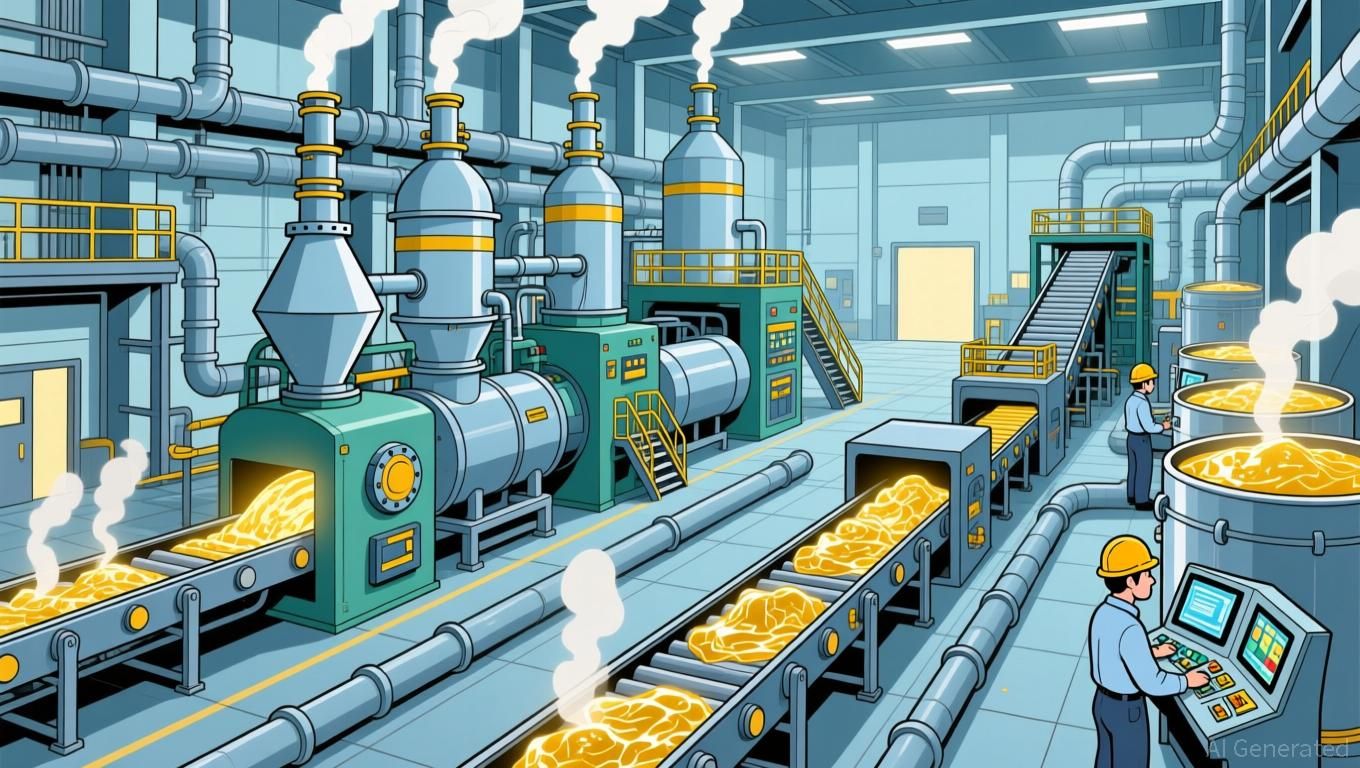

TRX Gold Corporation (TSX: TRX) is moving forward with an accelerated expansion of its processing facility at the Buckreef Gold Project in Tanzania, with the goal of increasing daily throughput to over 3,000 tons and surpassing the annual gold output of 62,000 ounces projected in its May 2025 Preliminary Economic Assessment (PEA), as reported by

This expansion utilizes cutting-edge methods like ultra-fine grinding and high-purity oxygen injection to concentrate 87–90% of gold into just 15% of the processed material, improving recovery rates, as detailed by . These technological upgrades are set to increase throughput and help maintain steady production costs, aligning with TRX Gold’s plan to generate strong cash flow and support additional exploration, Stocktitan reported. The Buckreef Gold Project, which contains 10.8 million tonnes of measured and indicated resources at an average grade of 2.57 grams per tonne gold, stands to gain from the expanded capacity, potentially lengthening mine life and increasing reserves, according to .

Major risks include the timing of equipment deliveries and meeting recovery rate goals within the allocated budget, but the company’s phased strategy and reliance on internal funding help minimize external risks, Stocktitan noted. Since its first gold pour in 2021 and three previous expansions, TRX Gold’s commitment to ESG practices and active stakeholder engagement in Tanzania have further enhanced its operational stability, according to .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod

Token Unlock Releases and Large Holder Sell-Offs Drive Ethena's 80% Value Decline

- Ethena's ENA token dropped 80% to $0.31 amid massive unlocks and whale selling, with 45.4% of tokens released in November. - Robinhood listing and Binance's USDe buyback program offer limited support as 6.8B tokens circulate and 5.99B remain locked until 2026. - USDe's $8.9B TVL and multi-chain expansion highlight potential, but technical indicators signal a possible 37% further price decline. - Analysts warn ongoing unlocks, whale activity, and crypto market volatility could prolong ENA's bearish trend

Web3 Rewards Program Fuels Surge in TWT and 1INCH

- Trust Wallet's TWT and 1INCH tokens gain momentum as Trust Premium loyalty program boosts user engagement and on-chain activity surges. - TWT trading volume rises to $32.98M while 1INCH hits $110.86M weekly volume, supported by technical indicators and ecosystem integrations. - TWT stabilizes above $1 with key resistance at $1.2935, while 1INCH tests $0.2330 level amid bullish MACD and RSI signals. - Trust Premium's tiered rewards and 1inch integration create flywheel effects, linking user activity direc

Bitcoin Updates: Bitcoin Stands Strong Against Withdrawals While Solana ETFs Spark Optimistic Investments

- Bitcoin stays above $100,000 despite ETF redemptions, driven by whale buying and Solana ETF inflows. - Solana ETFs attract $421M in 5 days, outperforming Bitcoin/ETH ETFs with $799M+ outflows. - Analysts link market resilience to institutional confidence in Solana, macroeconomic uncertainty, and seasonal crypto trends. - Grayscale's low-fee GSOL ETF enters market with $102M AUM, highlighting growing institutional demand for Solana exposure. - Long-term optimism persists as Bitcoin's $1T+ market cap chall