Solana emerges as institutional hub for RWAs: RedStone Report

A report by RedStone highlights how Solana is becoming the backbone of the blockchain infrastructure for capital markets.

- Solana holds $700 million in RWAs and $13.5 billion including stablecoins

- Network performance is a key driver of Solana’s growing dominance in the sector

- BlackRock, Apollo Global, Janus Henderson, and VanEck are among the big-name adopters

Solana ( SOL ) is emerging as the blockchain backbone of capital markets, capturing a major share of real-world asset tokenization. On Monday, September 29, blockchain oracle network RedStone published a report detailing Solana’s increasing dominance in RWAs.

According to the report, Solana hosts $700 million in RWA assets, and over $13.5 billion if including stablecoins. The RWA figure grew by more than 500% year over year, making Solana one of the largest networks for tokenized assets.

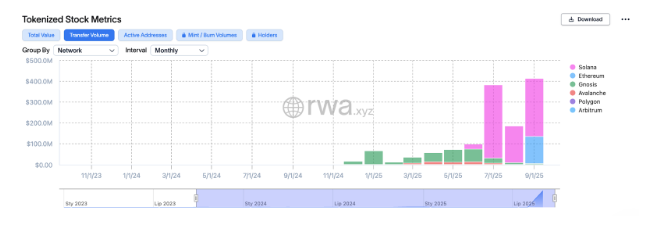

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

For instance, following the xStocks integration with the network, Solana (SOL) trading volumes for tokenized equities quickly surpassed those for Ethereum. This acceleration benefited from partnerships with exchanges such as Kraken , which aim to enable fast and low-cost transfers for their users.

Solana dominates through performance

RedStone’s report highlights Solana’s performance as one of the main reasons for its dominance in asset tokenization. According to the report, institutional investors rely on high throughput for their RWA applications. Solana, which boasts a capacity to handle up to 100,000 TPS, is a natural choice for many.

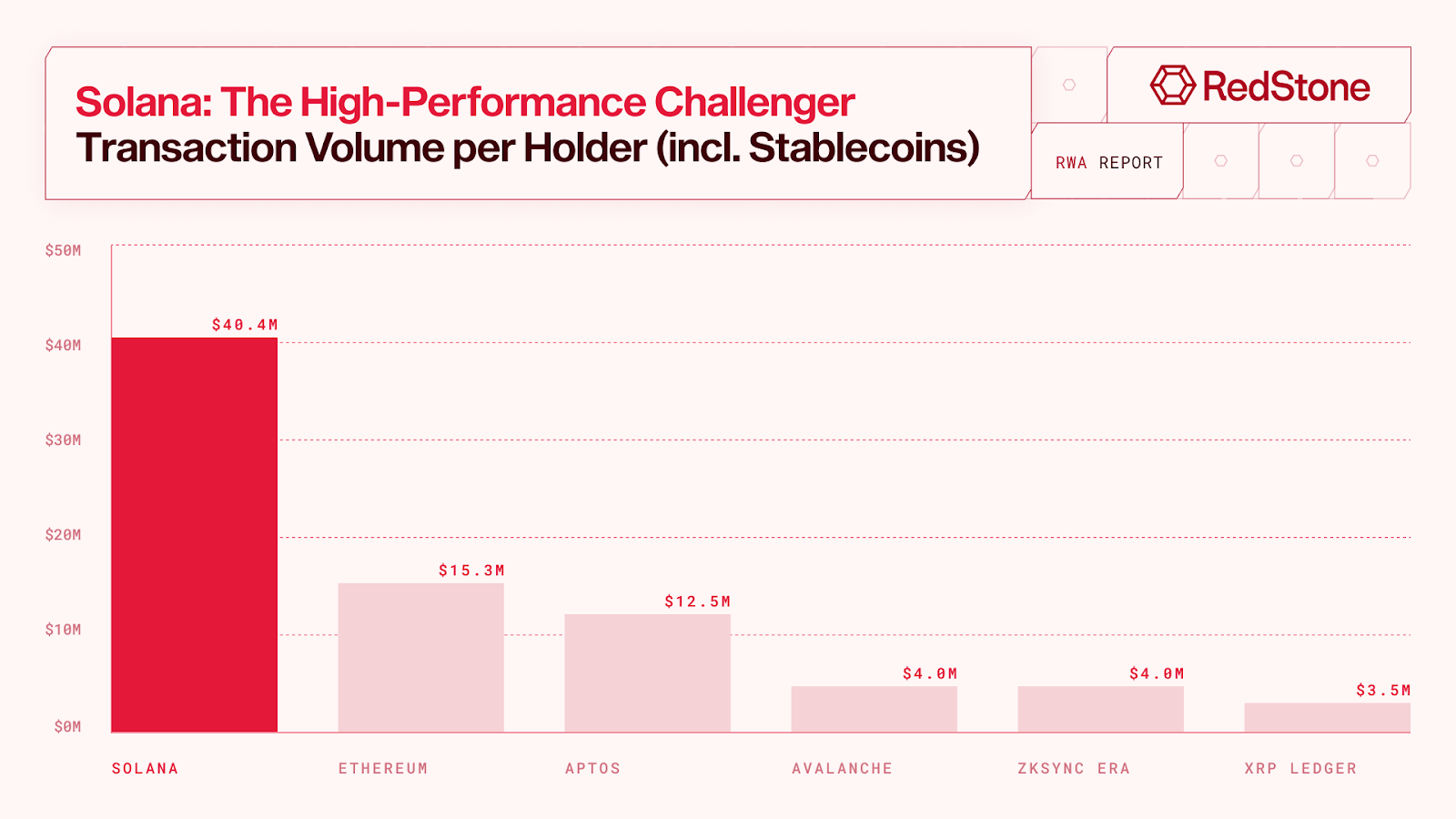

Transaction volume per RWA address on major chains as of June 2025 | Source: RedStone

Transaction volume per RWA address on major chains as of June 2025 | Source: RedStone

“For RWAs, there are really only 2 places: It’s either Ethereum or Solana,” said Robert Leshner, CEO of the tokenization platforms Superstate.

This performance has attracted big names to the network, including BlackRock, Apollo Global, Janus Henderson, and VanEck. Moreover, Solana also hosts popular applications like Phantom, Raydium, Jupiter, and Pump.fun, demonstrating its appeal among retail users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zuckerberg: *The Social Network* Captured My Mannerisms, But Not My Life

- Mark Zuckerberg praised *The Social Network* for accurately replicating his Harvard-era casual style, including owned T-shirts and fleece jackets. - He criticized the film's narrative, calling its portrayal of his Facebook motivations and fabricated romantic subplot "completely wrong." - Zuckerberg highlighted Hollywood's struggle to grasp tech entrepreneurship's intrinsic appeal, emphasizing real-world innovation vs. dramatization. - Despite narrative disagreements, he bought the film's iconic "Ardsley

Zcash Halving Scheduled for November 2025: Triggering Market Fluctuations and Attracting Speculative Investments

- Zcash's November 2025 halving will cut miner rewards by 50%, mirroring Bitcoin's deflationary model and tightening supply. - Historical data shows post-halving price surges, with Zcash's price rising 472% since October 2025 amid $137M institutional inflows. - Privacy-centric features (30% shielded supply) and speculative demand drive volatility, but regulatory risks and competition pose challenges. - Market dynamics highlight tension between scarcity-driven optimism and macroeconomic uncertainties affect

Solana News Update: Solana ETFs See $15 Million in Investments Despite Token Price Decline

- Solana ETFs gained $14.9M on Nov 4, contrasting Bitcoin and Ethereum ETF outflows. - Institutional demand driven by Solana's 7-8% staking yields and tokenized asset infrastructure. - SOL price remains bearish, trading below 9-day SMA at $186.92 despite inflows. - Upexi's 2.1M staked SOL holdings signal long-term confidence in Solana's value.

Bitcoin Updates: Crypto Market Divides as Pessimism Clashes with Institutional Confidence in Ethereum

- US stocks closed mixed on Nov 7, 2025, as Bitcoin fell below $100,000 amid $711.8M in crypto liquidations. - ARK Invest boosted Ethereum exposure by buying $9M of BitMine shares, signaling institutional confidence in ETH treasuries. - UK aligns stablecoin rules with US by Nov 10, while crypto firms form consortium to standardize cross-border payments. - Coinbase and Block underperformed revenue forecasts, with Block down 9% despite $6.11B revenue. - Market remains divided between Bitcoin bearishness and