News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Market Research and Analysis of Layer1 Public Chain QUBIC

Bitget·2024/07/01 06:19

Layer3 Foundation: Introducing $L3

Layer3 Foundation·2024/06/29 07:13

An interesting research analysis of the SCRAT market

Bitget·2024/06/29 06:58

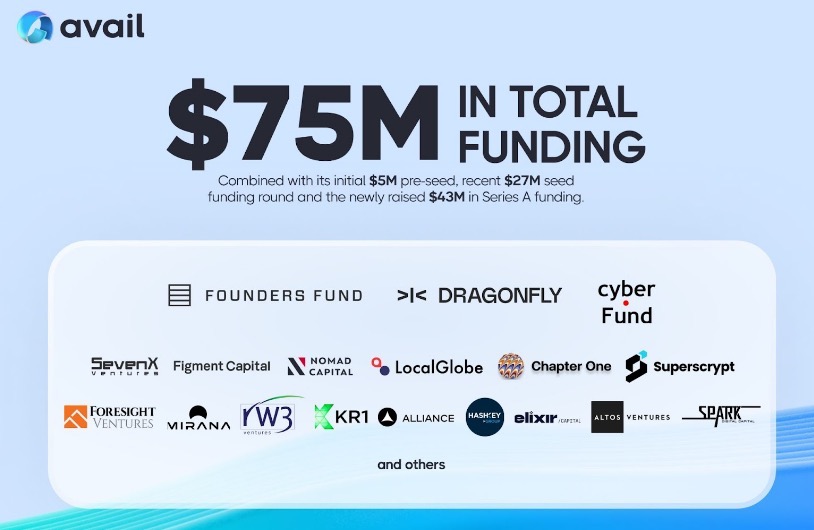

Modularization blockchain Avail market research analysis

Bitget·2024/06/28 10:11

Popular Bobo market research analysis

Bitget·2024/06/28 09:54

10 Reasons Why Bitcoin Could Fall to $55,000

Institutional Crypto Research Written by Experts

10xResearch·2024/06/28 07:00

BLASTUSDT is Now Available on Futures

Bitget launched BLASTUSDT futures on June 27, 2024 (UTC) with a maximum leverage of 50. Welcome to try futures trading via our official website (www.bitget.com) or Bitget APP. BLASTUSDT-M perpetual futures: Parameters Details Listing time June 27, 2024 12:00 (UTC) Underlying asset BLAST Settlement

Bitget Announcement·2024/06/27 12:00

SWGT: Creating blockchain scenarios between personal life and work

0x76·2024/06/27 11:14

Flash

- 03:31Ethereum treasury company Intchains Group acquires PoS technology platform under ECHOLINK for $1.3 millionAccording to ChainCatcher, citing Globenewswire, Ethereum treasury company Intchains Group has announced that it has signed a definitive agreement to acquire the proof-of-stake (PoS) technology platform under ECHOLINK Limited for $1.3 million, aiming to provide staking services on blockchains such as Ethereum, Avalanche, and Manta for individual and institutional investors. In addition, according to the latest data from Strategicthreserve, the company's current Ethereum holdings are approximately 8,820 ETH.

- 03:27Alliance DAO Co-founder: The Top of the 4-Year Crypto Cycle Is Emerging, US Stock Market AI Bubble Will Dominate Price MovementsJinse Finance reported that QwQiao, co-founder of Alliance DAO, recently stated in a post that although macro factors such as the Federal Reserve's quantitative easing (QE), the rebuilding of the U.S. Treasury General Account (TGA), and interest rate cuts all point to a market rally, intuitively it feels like everything is over. QwQiao described crypto as a self-fulfilling asset class, emphasizing the inevitability of the four-year cycle prophecy, which leaves the market at a crossroads of frustration. As a long-term optimist, he has felt uneasy about the crypto market since mid-September and has observed that most smart traders and long-term investors have turned bearish. Turning to U.S. stocks, QwQiao sees artificial intelligence (AI) as the only factor dominating the cycle, far surpassing liquidity indicators and technical signals. He warns that if the AI bubble bursts, the entire market will collapse; conversely, if AI-related stocks continue to rise, bears will be completely wrong. He compares NVIDIA (NVDA) to bitcoin in crypto, noting that when AI stocks (especially NVIDIA) rise, capital flows out of crypto and other assets, causing crypto to fall, and vice versa, forming a binary pattern of AI stocks vs. everything else.In specific sectors, QwQiao is optimistic about the growth momentum of stablecoin startups, believing their speed far exceeds that of AI startups, mainly because competition in the stablecoin market is scarce, while more than 50 players are already crowding the AI vertical. This year, his returns from U.S. stock investments have significantly outperformed crypto, and he has avoided high-growth but inefficient AI stocks, instead favoring quality companies at reasonable prices.

- 03:27Hourglass: The second phase KYC window for Stable pre-deposits has closed, and new applications will no longer be processed.Jinse Finance reported that Hourglass announced on the X platform that the second phase KYC window for Stable pre-deposits has officially closed. As part of the project wrap-up, due diligence will be strengthened to enhance defenses against Sybil attacks and maintain verification standards. All applications will undergo a final review. Hourglass added that support tickets for this window period have been closed, but dashboard status data may be updated. In addition, no new KYC applications or pending user information requests will be processed. Unverified users can withdraw funds via the Hourglass frontend or directly from the contract.