News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If Trump returns to the White House, could Bitcoin reach new highs

Bernstein analysts highlighted in their latest report that the US presidential election is likely to shape the future of the cryptocurrency world!

Jin10·2024/09/10 06:49

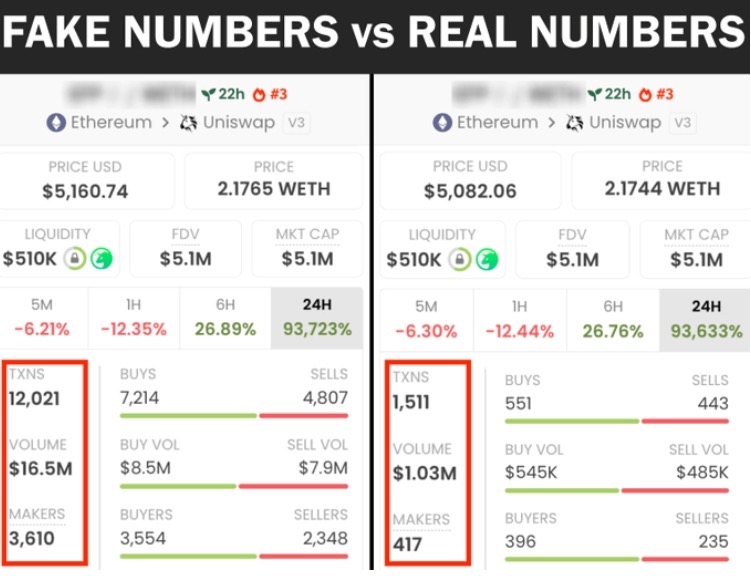

Without understanding this, you will lose all your money in cryptocurrency: Unveiling token manipulation on Dexscreener

BTC_Chopsticks·2024/09/09 10:32

Will the interest rate cut in September be 25 basis points or 50 How is the after-market

TVBee·2024/09/09 03:23

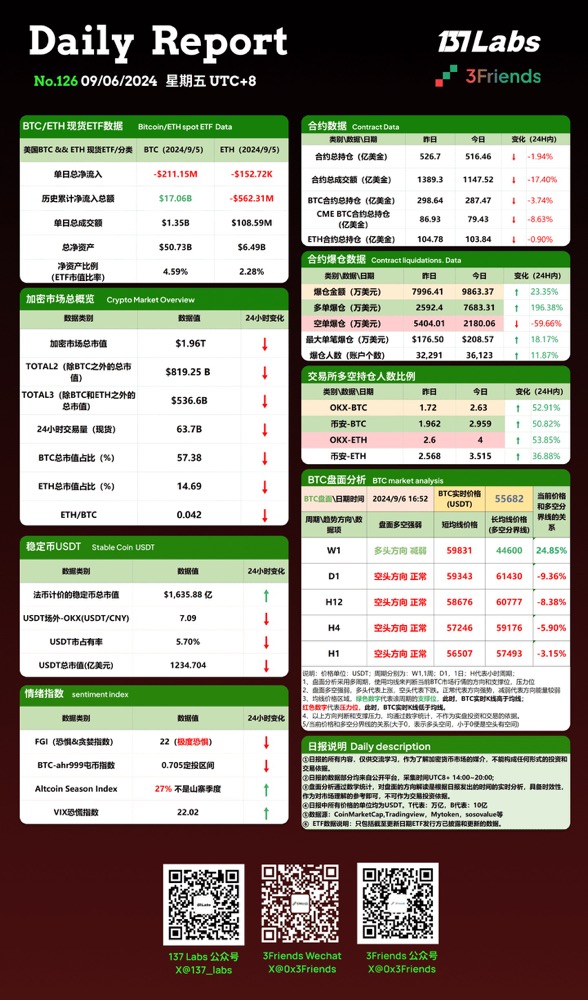

Daily BTC Market Briefing | Explore the Future of Crypto and Seize Market Opportunities

3Friends·2024/09/06 10:37

US job vacancies hit a three-year low in July as Bitcoin and US stocks rose

Bitget·2024/09/04 15:52

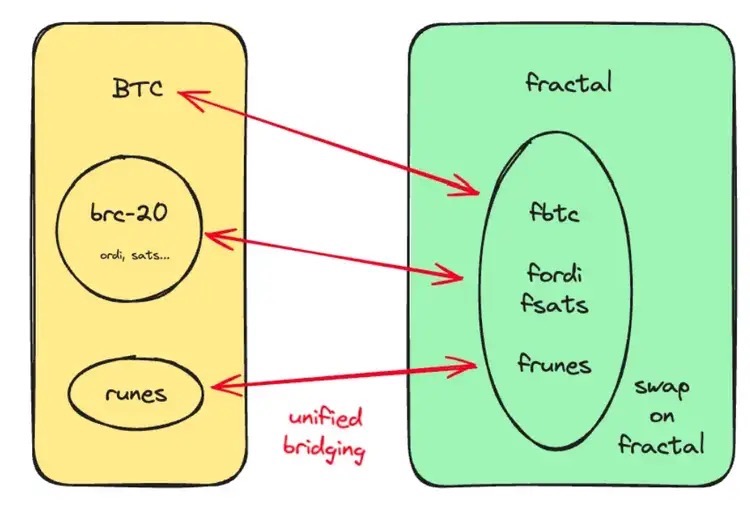

Can fractal Bitcoin overcome the computational power limitations of the Bitcoin chain

TechFlame·2024/09/04 10:12

Understand the intention behind Polygon $MATIC rebranding to $POL in an article

137 Lab·2024/09/04 06:13

Flash

- 04:52The US House of Representatives will vote at 5 a.m. tomorrow to decide whether to end the government shutdown, while several altcoin ETFs are awaiting SEC approval to be listed.BlockBeats News, November 12, the U.S. House of Representatives will vote tonight on whether to end the ongoing 42-day U.S. government shutdown. (Wednesday 4:00 PM Eastern Time, which is Thursday 5:00 AM Beijing Time) Once the government reopens, the market will gain access to clear data, which may to some extent eliminate the current pessimistic uncertainty. Previously, the U.S. Senate approved a bill to end the government shutdown on the morning of the 11th (Beijing Time), and has forwarded it to the House of Representatives. It is worth noting that currently, several spot ETF products for altcoins have already been listed on the DTCC (Depository Trust & Clearing Corporation) website, including XRP ETFs from five issuers such as Franklin and Bitwise, as well as 21Shares' Polkadot ETF, DOGE ETF, Sui ETF, and Bitwise's Chainlink ETF. Although this does not indicate that the ETF has received any regulatory approval or any definitive outcome of the approval process, listing on the DTCC website is considered a "standard procedure" for launching new ETFs. In addition, Canary has submitted an 8-A form for its XRP spot ETF, which is the final step before its application becomes effective. Once approved for listing by Nasdaq, the first XRP spot ETF may officially launch at the opening on Thursday. Institutions such as Swiss crypto banking group Sygnum have analyzed that investors are looking forward to the end of the government shutdown, which could prompt the U.S. SEC to "approve a batch" of altcoin ETFs, thereby catalyzing "a new wave of institutional capital inflows."

- 04:52Arthur Hayes: May Consider Increasing Holdings if ZEC Drops to the $300-$350 RangeBlockBeats News, on November 12, a co-founder of a certain exchange, Arthur Hayes, posted on social media that his total principal invested in ZEC has not yet reached his target position. If the price drops to the $300 to $350 range, he may consider increasing his holdings.

- 04:52Fed Mouthpiece: Fed's Disagreement on December Rate Cut Is GrowingBlockBeats News, November 12, Nick Timiraos, a Wall Street Journal reporter known as the "Fed's mouthpiece," stated that internal divisions within the Federal Reserve have cast a shadow over the path to rate cuts. During Fed Chairman Powell's nearly eight-year tenure, such a level of disagreement is almost unprecedented. Officials are divided over whether persistent inflation or a sluggish labor market poses a greater threat, and even the restoration of official economic data may not bridge the gap. Although investors still believe there is a high probability that the Fed will cut rates at the next meeting, this division has complicated a plan that seemed feasible less than two months ago.