Massive Crash in Circle Stock (CRCL): A Turning Point for the Stablecoin Giant?

Circle Internet Group (NYSE: CRCL), the company behind the USDC stablecoin, suffered a dramatic 12% single-day drop on November 12—the sharpest decline since its June IPO. The stock plunged from around $98 to $86, erasing a sizable portion of its post-IPO gains and raising alarms among investors and analysts alike. The sell-off was especially striking given Circle’s strong Q3 earnings and expanding role in global crypto infrastructure.

This unexpected rout comes at a critical juncture for Circle, which now ranks among the most systemically important firms in the digital finance space. With over $73.7 billion in USDC circulation and deep ties to institutional players like BlackRock and Visa, Circle’s stock movement is more than a typical market correction—it could signal a broader reevaluation of how investors perceive stablecoin business models in a changing interest-rate environment.

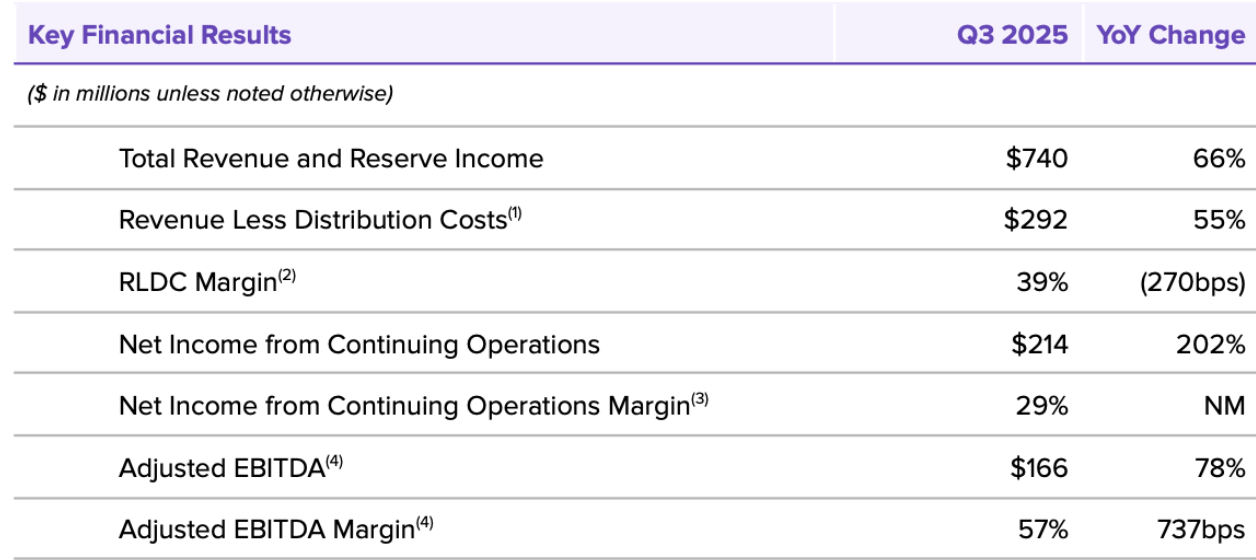

Q3 2025 Earnings and Fundamentals

Circle Q3 2025 Key Financial Results

Despite the sharp drop in share price, Circle’s third-quarter earnings showcased robust growth across key business metrics. Revenue reached $740 million, marking a 66% year-over-year increase and surpassing analyst expectations. Net income soared to $214 million—more than tripling from the same period last year—while adjusted EBITDA grew 78% to $166 million. Earnings per share (EPS) came in at $0.64, handily beating the consensus estimate of around $0.20.

The lion’s share of Circle’s revenue—roughly $711 million—came from interest earned on the reserves backing its flagship product, the USDC stablecoin. These reserves are primarily held in U.S. Treasuries and cash equivalents, making Circle acutely sensitive to interest-rate shifts. Meanwhile, non-interest revenue streams, such as transaction fees and product services, remain relatively modest in scale.

Operationally, Circle also reported continued ecosystem expansion. USDC circulation topped $73.7 billion in Q3, more than doubling year-over-year and comprising about 29% of the global stablecoin market share. Transaction volume for USDC hit $9.6 trillion, and wallet adoption surpassed 6.3 million unique addresses—underscoring Circle’s role as a critical piece of digital payment infrastructure.

However, the company also revised its full-year operating expense guidance upward to between $495 million and $510 million, up from the previous range of $475 million to $490 million. Much of this increase is tied to investment in its next-gen blockchain project “Arc,” and a broader hiring spree aimed at expanding its technology stack and compliance infrastructure. While the topline growth narrative remains intact, rising costs and interest-rate sensitivity have complicated the bullish case in the short term.

Wall Street Analysts Split on Circle Stock (CRCL) After Massive Price Crash

Circle Internet Group (CRCL) Stock Price

Source: Yahoo Finance

The market’s response to Circle’s strong Q3 performance was anything but uniform, and Wall Street analysts remain sharply divided on the stock’s trajectory. In one of the most notable moves following the earnings release, J.P. Morgan upgraded Circle to Overweight and raised its December 2026 price target from $94 to $100. The bank cited Circle’s expanding high-margin stablecoin platform and the company’s “solid fundamental momentum” despite the broader market volatility. The upgrade signaled that, at least for some institutions, the recent pullback may represent a value opportunity rather than the start of a deeper downturn.

But not all analysts share that optimism. Mizuho Securities initiated coverage of Circle with a starkly contrasting Sell rating and an $85 price target. Analyst Dan Dolev argued that consensus revenue expectations are too high, especially if U.S. interest rates continue to decline and USDC adoption normalizes after its massive growth spurt. Dolev warned that emerging competition—from stablecoins launched by PayPal, Ripple, and other fintech players—could further pressure Circle’s share of the market. He also estimated that Circle’s long-term revenue forecasts may be overstated by 25–30%, a bearish view that reverberated across trading desks.

The split signals how complex Circle’s business model has become as the company straddles both traditional finance and crypto markets. Some see the firm as a high-growth fintech with long-term staying power; others view it as overly dependent on rate-driven reserve income at a time when yields are heading lower. Retail sentiment has also been mixed, with traders noting that CRCL had risen around 18% since its IPO—leaving valuations elevated ahead of the earnings release.

Macro and Market Factors Behind the Crash

Beyond company-specific issues, broader macroeconomic pressures played a central role in Circle’s sudden stock decline. The most significant factor was a shift in interest-rate expectations, which directly affects Circle’s core revenue engine. Because USDC reserves are largely invested in short-duration U.S. Treasuries, Circle earns substantial interest income—about $711 million of its $740 million Q3 revenue came from reserve yield. As markets increasingly priced in further Federal Reserve rate cuts, investors grew concerned that Circle’s earnings power would decline in future quarters.

This fear wasn’t unfounded. Circle revealed that its reserve yield had already fallen sharply in Q3, dropping roughly 0.96 percentage points to around 4.15%. Lower yields mean each dollar backing USDC generates less income, pressuring profitability even as stablecoin circulation grows. The market reacted swiftly, viewing this compression as an early sign that Circle’s record-breaking revenue growth may be difficult to sustain in a falling-rate environment.

Adding to the pressure, broader economic sentiment has turned more cautious. A recent Reuters economist poll showed nearly 80% expecting additional Fed rate cuts by December, heightening concerns that Circle’s interest-driven revenue model may be entering a period of structural decline. In an unexpected twist, Fed Governor Stephen Miran even suggested that mass adoption of stablecoins like USDC could lower the U.S. economy’s neutral interest rate—potentially anchoring yields at lower levels for longer.

At the same time, Circle’s rising expenditure intensified market nerves. The company raised its full-year operating expense forecast to $495–510 million, citing accelerated hiring and heavy investment in its next-generation “Arc” blockchain network. While these initiatives support Circle’s long-term ambitions, they also squeeze margins at a time when revenue growth may be cooling.

A final layer of pressure came from market mechanics. With Circle’s IPO lock-up period set to expire shortly after the earnings release, investors feared early backers and insiders might begin selling shares. That concern—paired with a broader tech-sector pullback—amplified volatility and contributed to the steep intraday drop.

Collectively, falling rates, margin pressures, and fragile market sentiment created a perfect storm, turning what might have been a routine earnings pullback into Circle’s worst sell-off since going public.

Institutional Investors Buy the Dip in Circle Stock (CRCL)

Amid the sharp drop in CRCL, one of the most notable developments was the aggressive buying from major institutional investors. The most prominent move came from ARK Invest, led by Cathie Wood, which stepped in during the downturn to accumulate a sizeable position. On November 12, ARK purchased 353,328 shares of Circle—valued at roughly $30.5 million—across its flagship ETFs, including ARKK, ARKW, and ARKF. This brought ARK’s total exposure to Circle to more than $150 million, signaling high conviction in the company’s long-term trajectory despite short-term volatility.

ARK’s buying streak stood in stark contrast to the broader market reaction. While retail traders and short-term players rushed for the exits, Wood’s funds treated the sell-off as a discount entry point. Historically, ARK has taken early positions in disruptive fintech and blockchain companies, and this move suggests the firm views Circle as a core infrastructure player in the future of digital payments.

Beyond ARK, Circle continues to benefit from its roster of high-profile backers. BlackRock was an early investor and remains a strategic partner in managing USDC reserves. Fidelity’s involvement through senior leadership adds another layer of institutional credibility. Although no major funds publicly disclosed selling during the decline, the timing of Circle’s IPO lock-up expiry did raise concerns that early insiders might begin taking profits soon, adding a psychological overhang to the stock.

Outlook: Panic Sell-Off or a Long-Term Turning Point?

Circle’s sudden stock crash has divided investors on whether this is a temporary panic or a sign of deeper structural challenges ahead. On one side, the company’s underlying growth story remains compelling. USDC adoption continues to accelerate under increasingly clear regulatory frameworks, with the U.S. recently passing the GENIUS Act to formalize oversight of dollar-backed stablecoins. Circle’s expanding partnerships with major financial players—ranging from BlackRock to Visa to HSBC—position the company at the center of the shift toward on-chain digital payments. Supportive voices like JPMorgan and ARK Invest argue that the long-term demand for stablecoin infrastructure will outweigh short-term earnings pressures.

Circle’s management has echoed this optimism. CEO Jeremy Allaire has emphasized that stablecoins are becoming “part of the plumbing of the internet,” and Circle remains one of the most trusted issuers in the space. If the company can continue growing USDC’s circulation, diversify its revenue streams, and move beyond its dependence on interest income, the long-term trajectory may remain intact even in a lower-rate environment.

However, the bearish case is also gaining traction. Circle’s business model is undeniably sensitive to interest-rate cycles, and with economists expecting additional Fed rate cuts, future reserve income may decline further. Mizuho’s projections of a 25–30% downside to forward revenue estimates highlight how exposed Circle might be if USDC growth begins to normalize. Competition is intensifying too, with PayPal, Ripple, and other fintech giants launching their own stablecoins—raising the possibility that Circle’s market share may face pressure.

There are also near-term risks that could weigh on sentiment. The rise in operating costs, especially around building the Arc blockchain and expanding headcount, threatens to compress margins at precisely the moment when revenue tailwinds are weakening. The expiration of Circle’s IPO lock-up period adds another layer of uncertainty, raising the possibility of insider selling and additional stock volatility.

Conclusion

Circle’s steep post-earnings sell-off underscored just how tightly its stock is tethered to shifting macroeconomic conditions. Even with exceptional Q3 growth—rising revenues, expanding USDC circulation, and surging profitability—the market zeroed in on falling reserve yields, higher operating expenses, and expectations of deeper Fed rate cuts. These pressures combined to create a perfect window for a dramatic repricing, pushing CRCL to its worst single-day decline since going public. The episode highlighted a crucial reality: Circle’s financial engine may be powerful, but it remains deeply sensitive to interest-rate dynamics and investor sentiment.

Yet, the crash also revealed another side of the story. Institutional buyers like ARK Invest used the downturn to significantly increase their exposure, while major banks such as JPMorgan argue the long-term fundamentals remain intact. With stablecoins gaining regulatory clarity, USDC continuing to scale globally, and Circle pushing into new infrastructure initiatives like its Arc network, the company still holds a strategic position at the center of digital finance. Whether this sell-off marks a short-lived panic or a deeper valuation reset will depend on how effectively Circle can diversify its revenue, manage costs, and navigate a potentially lower-rate environment. For now, CRCL remains one of the most closely watched—and hotly debated—stocks in the crypto-fintech world.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.